Many credit unions are using the same digital marketing tactics meaning your audience is flooded with similar messages from your competitors.

However, successful credit unions are finding that when they implement direct mail into their marketing strategies, they are generating more leads, turning more leads into clients, and enhancing current member relationships. This is because your audience may be flooded with emails and passing by the countless display ads, but they aren’t ignoring the messages in their mailboxes.

Here are some effective credit union direct marketing strategies that can help you increase your client base, differentiate you from competitors, and strengthen your member relationships.

Direct Mail Automation for Credit Unions

Anything you do with email in your CRM you can do with direct mail as well.

For example, when a thank you email is automatically sent to a client, you can send a thank you postcard instead to increase engagement and build better member relationships.

It works by using Direct Mail Automation which connects your CRM—like HubSpot, Salesforce, Active Campaign, etc.—with your print and direct mail provider.

You set up triggers, or events that are relevant to your goals, like when you gain a new client, or a client’s loan is near completion. This trigger is then automatically sent to your print and direct mail provider. They harness your data and send your direct mail piece at exactly the right time, so your new client receives a welcome postcard, and your other client receives a letter offering the next steps about their loan.

Credit Union Marketing Examples to Take Advantage of With Direct Mail Automation

Client Onboarding

When a new client signs on or comes on board, it’s important to reach out to them in a timely fashion to establish a more meaningful relationship from the very beginning as your onboarding process is the first impression your new member will get of what it’s like to work with your credit union.

You may already send welcome emails, but nothing provides a better first impression than a letter in the mail. In fact, 70% of people say direct mail is more personal that online interactions, which means direct mail is the perfect way to welcome your new members effectively.

With Direct Mail Automation you can automatically send a welcome message to new clients as soon as they open an account.

Trigger-based Campaigns

Triggers in a trigger-based campaign are any event a prospect or client makes that creates an automated response.

For example, if someone is searching for or has bought a new car, a letter offering information on an auto loan could automatically be sent.

There are many variations of triggers you can implement to meet your credit union’s specific goals. Just a few examples include:

- When a CD is maturing

- When a loan is near completion

- Transactional based triggers—when someone buys a car or new home

Life-Event Triggers

Many people choose to go with a credit union rather than a bank for many reasons including lower fees and interest rates, but they also often choose a credit union because credit unions offer a more personable experience making them feel more valued.

So why not make them feel even more valued?

With life-event trigger-based marketing, you can reach out to clients and prospects with a personalized postcard or letter on their birthdays, anniversaries, when they become a new homeowner, a new parent or get married.

This personalized information is easy to acquire and can increase response rates by 135%. It can be pulled from your existing customer data or mined from database appends (new data that can be added to your existing database.)

Client Shows Interest in Getting Help with a Financial Issue

Your credit union talks to clients and potential ones every day and many of those individuals may show interest in getting help with a financial issue but won’t commit to receiving your help right away.

Plus, there are countless prospects out there who your credit union hasn’t interacted with yet but who are in need of your financial assistance.

To keep your credit union top of mind, or to simply introduce your credit union to new prospects, you need to reach out to them in a tangible and more effective way that reaches up to 90% open rates.

To achieve this try sending them a personalized letter when:

- They show interest in building a retirement income plan

- They are reviewing current investment strategies

- They are searching for alternatives to low CD rates

Other Effective Credit Union Marketing Ideas

Direct Mail Automation is one of the most cost-effective and proven ways to market your credit union. However, there are a a few other extremely effective ways to grow your credit union’s client base.

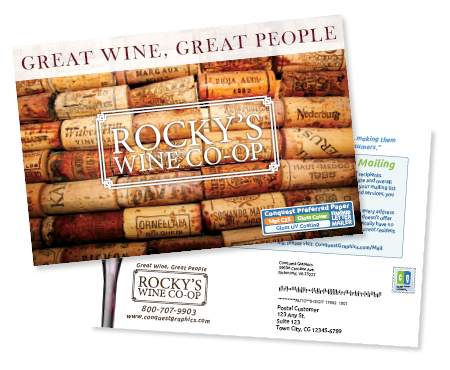

Radius Mailing

With Radius Mailing, or Proximity Mailing, you can market to those who surround your most successful clients to build brand awareness in a certain area.

Or you can send a direct mail piece to those who surround your credit union to let them know you're close by and can offer services to help with their financial needs.

Direct Mail Retargeting

Direct Mail Retargeting, or Mailbox Retargeting, allows you to send your anonymous web traffic well-timed and relevant emails and direct mail for a better chance at converting your website visitors.

Propensity Mailing

With Propensity Mailing, you can target potential clients who are interested in and in-market for the services and products your credit union provides.

This includes:

- People likely to bank with your competitor

- Individuals who view customer service as very important when choosing a credit union

- Interest rates are very important to them

- Location of credit union is very important

- Likely to switch financial provider

- Had Certificates of Deposit for more than 6 months

- Interested in a retirement plan

- And many more

Look-Alike Analysis

Look-Alike Analysis is a marketing tactic that analyzes your current client data to gather a list of potential clients who share the same exact key characteristics as your most successful members.

Effective Credit Union Direct Mail Materials

Postcards

Postcards are typically used to send short, promotional messages like advertising auto loans with low rates and no annual fees to potential clients or wishing a current client a happy birthday.

Advantages of using postcards for your credit union marketing strategy include:

- They are perfect for quick messages that get immediate attention

- They are extremely cost-effective

- Postcards are highly targeted and trackable

- They build better brand awareness

- They include personalization options to maximize impact including names, images, etc.

Letters

Letters along with a branded envelope are used for messages that may hold more private information.

Advantages of using letters for your credit union marketing strategy include:

- They are perfect for private or official messaging

- They are delivered extremely fast

- The envelope and letter can be branded to strengthen brand recognition

- Allows for more content to be printed within your message, including multiple pages

- They include personalization options to maximize impact including names, account numbers, etc. s

To get started on your effective credit union marketing strategy click the button below to explore all our most popular credit union materials, including brochures, booklets, pocket folders, and more. And credit union solutions so you can start gaining new clients and strengthening your member relationships today.

Explore More Today!

Contact a Direct Mail Expert Now!

Call 804-591-3352 to get directly in touch with one of our mail experts, any time from 8A - 7P ET.